A disability income policyowner recently submitted a claim, igniting a captivating narrative that delves into the intricacies of disability income insurance and its profound impact on individuals facing unforeseen circumstances. This meticulously crafted exploration unveils the purpose, benefits, and complexities of such policies, while shedding light on the pivotal role they play in safeguarding financial security during times of adversity.

As we delve into the details of this case, we will examine the policyholder’s profile, the nature of their disability, and the rigorous evaluation process employed to determine eligibility for benefits. Furthermore, we will explore the nuances of claim payment, case management, and the potential for appealing decisions, providing a comprehensive understanding of the intricate landscape of disability income insurance.

Disability Income Policy Overview

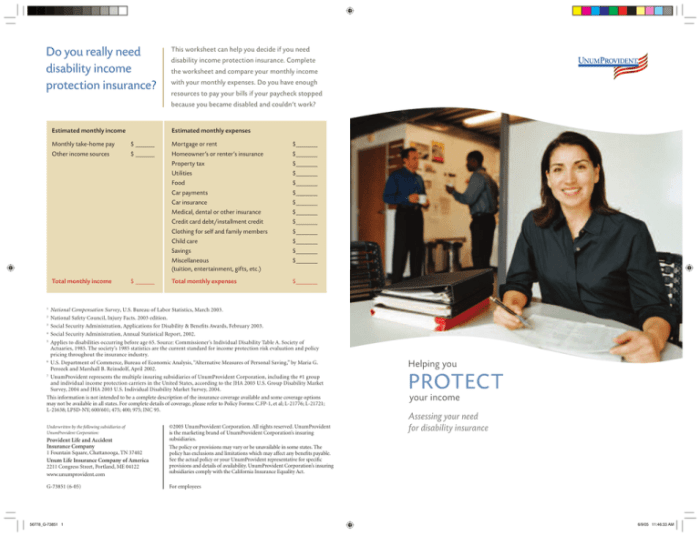

A disability income policy provides financial protection in the event of a disability that prevents an individual from working. It ensures that policyholders can continue to meet their financial obligations, such as mortgage payments, living expenses, and medical bills, even if they are unable to earn an income due to a covered disability.

There are different types of disability income policies available, each with its own unique features and benefits. Some common types include:

- Short-term disability insurance:Provides coverage for disabilities that last for a limited period of time, typically up to 6 months.

- Long-term disability insurance:Provides coverage for disabilities that are expected to last for a year or more.

- Own-occupation disability insurance:Provides coverage if the policyholder is unable to perform the duties of their specific occupation.

- Any-occupation disability insurance:Provides coverage if the policyholder is unable to perform any occupation for which they are reasonably suited.

Key features and provisions of a disability income policy may include:

- Benefit period:The period of time during which benefits are payable, typically ranging from 2 to 5 years or until retirement.

- Waiting period:The period of time after the onset of disability before benefits begin, typically ranging from 30 to 90 days.

- Benefit amount:The monthly benefit amount payable during the benefit period, typically expressed as a percentage of pre-disability income.

- Definition of disability:The specific criteria that must be met in order to qualify for benefits, such as inability to perform the duties of one’s occupation or any occupation for which one is reasonably suited.

- Exclusions:Conditions or circumstances that are not covered by the policy, such as self-inflicted injuries or disabilities caused by pre-existing conditions.

Essential FAQs: A Disability Income Policyowner Recently Submitted

What is the purpose of disability income insurance?

Disability income insurance provides financial protection in the event that an individual is unable to work due to a disability, ensuring a continuation of income to cover essential expenses.

What are the different types of disability income policies available?

There are two main types of disability income policies: short-term disability insurance, which provides benefits for a limited period of time, typically up to 26 weeks, and long-term disability insurance, which provides benefits for an extended period of time, often until retirement age.

What are the key features and provisions of a disability income policy?

Key features and provisions of a disability income policy include the definition of disability, the benefit period, the elimination period, and the monthly benefit amount.